BAS-Enterprise. Salary

Accruals

The composition of the accruals divided into groups in such a way that within the same group, the calculation procedure for all accruals is the same. It provides a replenishment of the accruals list, removing and replacing them by adjusting the directories corresponding to each group, without changing the calculation procedures and the interface part of the program.

All accruals divided into the following groups:

- Time-based salary;

- Piece-rate salary;

- Personal allowances;

- Personal surcharges;

- Vacation;

- Hospital sheets;

- Other charges.

Time-based salary accrued for time worked. The data for the calculation are the official salary, the time fund, the mode of operation. The calculation of time-based wages depends on the application of the program.

One and the same employee can combine several time jobs in the same enterprise, for example, combine positions and replace other employees. If sources of financing used in the enterprise, then the workplace data include information about the financing source.

Piece-rate salary. In the end, it is calculated as the product of the quantity of products received (services rendered) per unit value of this product (service).

Personal allowances are accruals that are directly proportional to the time salary and assigned as a percentage of it. Examples of allowances are: for long service and an extended work area.

For each personal allowance, the place in the time salary to which it allowance applies indicated. If the allowance refers to several places of work of the employee, then it is entered the appropriate number of times. Such a mechanism is adopted because the designated allowance for one the job can not be applied to another.

Accounting of allowances associated with the accounting of time-based wages. The account of debit and credit of postings coincides with the posting accounts for that place work, to which the salary surcharge applies.

Personal surcharges. The surcharges divided into two groups: permanent and one-time. Constant surcharges depend on the hours worked, and therefore they are linked to the place of the employee, as entered on the list of one-off every time they are assigned.

Accounting for additional payments depends on their type. Some of them relate to the same accounts as the basic salary, while for others the expense account set rigidly, for example, material assistance at the expense of profit.

Money for vacation, are calculated on the basis of weighted average accruals for prior periods. There are different types of vacations, for example, tariff, training, maternity. For storage of a set of types, and for the definition of features of their calculation and accounting the directory used.

Hospital sheets also calculated on the basis of weighted average accruals for prior periods. There are also various types of hospital charges, for example, at the expense of the enterprise, due to social insurance, etc. For storage of a set of types, and also for the definition of features of their calculation and accounting the directory used.

The difference from holiday data is the record of the length of service in determining the amount and length of the period for obtaining a weighted average wage.

Other charges are all those that not included in the previous groups. They do not depend on the time worked. They are entered every time the salary calculated for the next reporting period.

Salary deduction

All salary deductions divided into groups so that within the same group method of calculation was the same all deduction. It provides a replenishment of the list of salary deduction, removal, and replacement of them by adjusting the directories corresponding to each group, without changing the calculation procedures and the interface part of the program.

All salary deductions divided into the following groups:

- Income tax;

- Deduction in percentage of salary;

- Third-party deduction;

- Other deductions.

Income tax has a nonlinear dependence on a number of earnings. In its calculation takes into account tax calculation method (regular employees or a part) and the benefits provided.

If several types of financing are used at the enterprise, the income tax calculated for the employee on the basis of his overall earnings is distributed among all sources of financing. The most common criterion of distribution is proportional to the salary received from each source. The need to solve the distribution problem is due to the non-linear scale of the income tax.

Salary deductions as a percentage of wages are deductions proportional to a part of the salary. These include, for example, pension fund, social insurance, trade union fees. For all these deductions, there are rules for determining the amount with which they withheld, the limits of withholding (minimum and maximum amount), and percentages.

The list of deductions supported in a directory. For each payroll deduction, data is entered into it to calculate the amount and accounting.

Third-party deductions are a part of the earned money that the employee receives not himself, but sends it to other recipients. Examples are alimony, fines, loan repayment, payment for utilities, etc.

Types of third-party salary deduction are with data for their calculation and accounting maintained in a handbook. And directly the list of deductions for the employee and the requisites of the recipient are entered in the data about this employee (personal account card).

Other deductions are preliminary payments in various forms, for example, advance payment, payment for products, etc. They entered during the reporting month. For their calculation and accounting, a reference book is used.

Employee turnover data

Employee turnover data are maintained by salary. A standard set of parameters is used:

- Initial balance (debit and credit);

- Issued (debited);

- Accrued to extradition (credit);

- The balance is finite (debit and credit).

The opening balance is transferred to the current reporting month from the final balance of the previous month. There is a possibility of adjusting the balance that is used when the program is put into operation or when the current wage arrears change without corrective entries.

Issued salary is the amount of reduction of arrears of salary for the current month. It collects all options for the payment of salaries for previous periods or for the current period after the final calculation of salary. It does not include preliminary payroll, which is included in a number of other deductions.

Accrued salaries for extradition are the difference between "Total credited" and "Totally deduction". This amount is determined based on the results of calculations.

The final balance is the calculated amount, defined as "opening balance" plus "Issued" - "Accrued to issue". The negative amount is placed on credit, and the positive amount is debited.

The negative amount is placed on credit, and the positive amount is debited. In the case of a debit balance at the end, it appears as an employee′s debt. In the next reporting month, the program generates the operations "Return of the debt" (credit posting) and "deduction the debt of the previous month", which is included in the "Totally deduction" for providing information to the employee.

If the enterprise uses several sources of financing, then the turnover is conducted for each source separately. The balances at the beginning and end of the period coincide with the balances in the corresponding accounts of the general ledger, and the turnover coincides with the turnover in the respective accounts.

Depositor.

There are built-in operations for transferring to the depositor, issuing from the depositor. Also, the turnover of the depositor is similar to that of wages.

REPORTS.

The module contains all the necessary reports that are required in the accounting of wages. These are calculated and consolidated statements, issuance sheets, certificates, etc.

FUNDS.

Funds are the money that an enterprise must transfer to the budget for paying salaries to employees, for example, unemployment fund, and social insurance fund, industrial accidents fund. The list of accruals to funds is maintained using a special directory. For each type, data on the amount (percentage) and data for accounting are recorded.

The amount for each fund is calculated based on the final salary data for each source of funding. The calculation of postings on funds is preceded by the calculation of the final accounting transactions reflecting the calculation of the salary for all expenditure accounts. For each received posting, the corresponding entries for the funds are formed. The debit of the posting account for funds coincides with the debit of the main posting account, and the credit of the account reflects the accounting of the corresponding fund. A number of accounting transactions is a specified percentage of the amount of the accounting transactions.

The composition of the funds and their parameters are indicated in the special setup operation "Enterprise funds". It also indicates the period of validity of the information provided in the operation.

INFORMATION FOR THE THIRD-PARTY ORGANIZATIONS.

There are many types of data and reports that a salary accountant must submit in one form or another to various third-party organizations.

Some of these reports are transmitted on the prescribed forms. To do this, in the module "Salary" there are special operations for retrieving data in these reports and printing them in a specified form, for example, reports in statistics. All such reports are generated in semi-automatic mode. After software development, the accountant has the opportunity to make manual adjustments to the report and only then send data for printing.

The second group of reports provides for the preparation of data on computer media, for example, on floppy disks. For such reports, the module is configured to export data to files with the type and with the structure provided by the receiving organization.

The approach to the formation of reports provides for a separate operation for each report, behind which the calculation SQL procedure and a template for printing the data are fixed.

Accounting

Simultaneously with the calculation of the amount of accrued or deduction salaries for employees, accounting transactions are created that reflect the accounting of salaries.

Accounting transactions are formed in those places where there are data on the types of production for which the work of workers (expenditure part) is directed or information about methods of payment (sources of payment of wages). In addition, during the accrual of funds, the accounting transaction necessary to reflect the accounting records of these funds is formed.

Accounting for the time salary is performed for each work place separately. Calculation of the amount of accrued time wage is carried out according to the time sheets. Accounting transactions are generated for each time sheet. When you enter each record in the report card, the code of the personal account, the place of work for which the salary and time worked is entered into it. Data on the official salary, time fund, work schedule, the calculation procedure is taken from the directories.

To account for piece-rate salary during the entry of data in the orders, a cost account is indicated, to which the amount of the accrued salary (debit) refers, and the source of financing through which work is performed on this side. A number of accounting transactions is the total amount of the accrued salary for all employees entering this outfit and having this combination of "debit" - "credit" account.

Accounting of vacation and sick-list is fixed for the operations of their accrual. Accounting of surcharges and other charges and deductions is made when performing a general calculation.

Accounting transactions are configured when you configure transactions. The chart of accounts is taken from the "Balance" program. Initial balances on accounts in the first month of operation of the program are taken from the "Balance" program, and then from the previous month.

There is a special operation to enable the entry of manual accounting transactions. It is used mainly only at the initial stage of the program′s operation as part of the accounting system when not all the accounting transactions are set up, but the report in the "Balance" should be transferred.

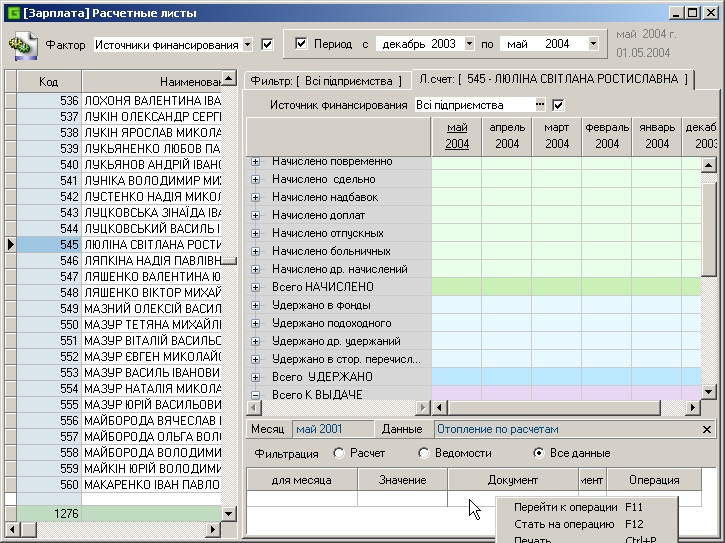

THE RESULTS ANALYSIS WINDOW

The results analysis window allows you to perform the results of manual and settlement operations performed in different reporting periods with varying degrees of detail in the data.

The specified period of time allows not only to view the results of the received operations but also to perform a direct transition to any operation of any period of time. At the same time, if this period is not yet closed, then operative correction of the operation data is possible if it is allowed by the user′s access rights.

From this window, you can also print various documents for the current (displayed in the window) personal account, for example, a certificate of income, a counterfoil on charges and deductions, a reconciliation statement for an arbitrary period of time.

USEFUL LINKS:

Приватне підприємство «Науково-дослідне і конструкторсько-технологічне бюро автоматизованих систем»(скорочено ПП «

БАС»)

Частное предприятие «Научно-исследовательское и конструкторско-технологическое бюро автоматизированных систем»(сокращенно ЧП «

БАС»)

Scientific-research and design-technological bureau of automated systems(abbreviated as

BAS)