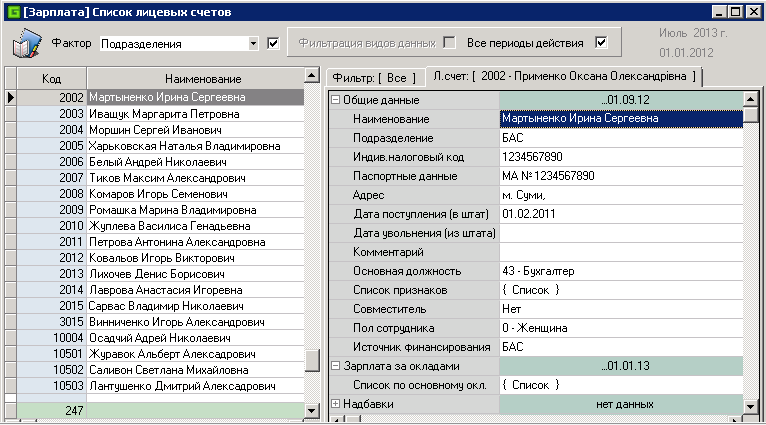

Information about personal accounts contains the composition of employees, various parameters for performing calculations and the history of changing parameters. To work with personal accounts a special window is used. Functionality and work in it (add, see, change, delete) with is described in the manual "General modes of operation". This section describes the purpose and operation of the data used.

GENERAL information

During the reporting month, as the data on the employee (orders) are received, data on the employee in his card are corrected and supplemented. These include:

· Personal number, name;

· Individual tax code;

· Passport data;

· The unit in which he works;

· Date of receipt, dismissal;

· Position (rank);

· Type of employment contract;

· Profession, position;

· Sign of maternity leave;

· A comment.

Composition of the general data of the personal account

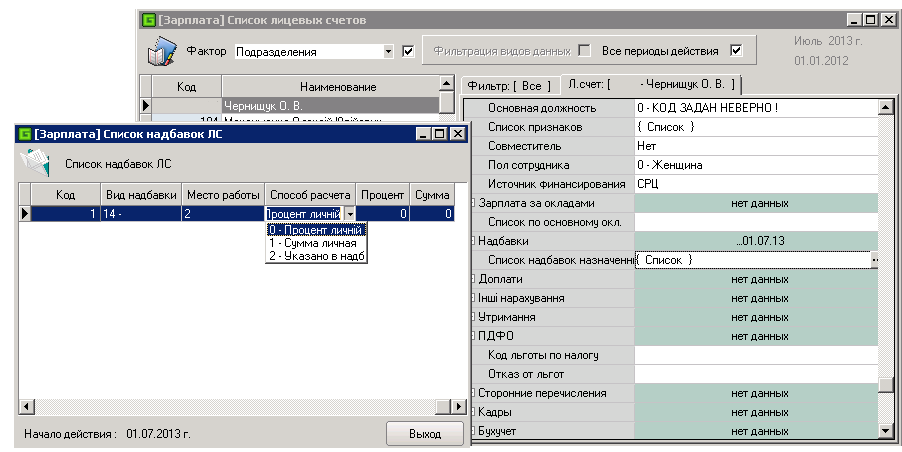

Data on the increase in pay and bonuses to salary.

A list of all allowances received by the employee is entered. A special record is created for the extra charge. Each record of the list is entered:

· Code of salary increments;

· A comment;

· Type of allowance to the salary;

· Place of work;

· Method of calculation;

· Amount or percentage.

Enter a list of salary increments

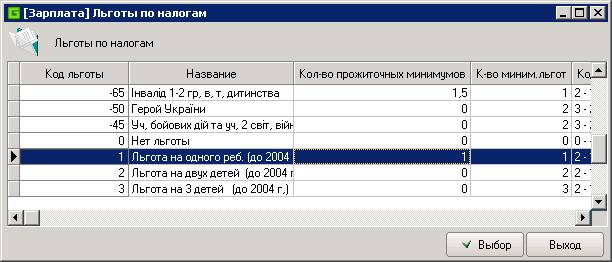

BENEFITS ON THE APPROPRIATE TAX.

If the employee has an income tax benefits, then his code from the directory of types of tax benefits is entered for this employee. The guide of benefits is introduced by the accountant (as a setter).

Entering tax benefits.

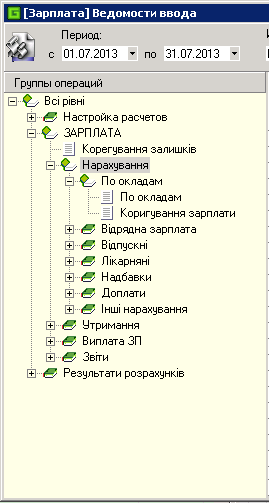

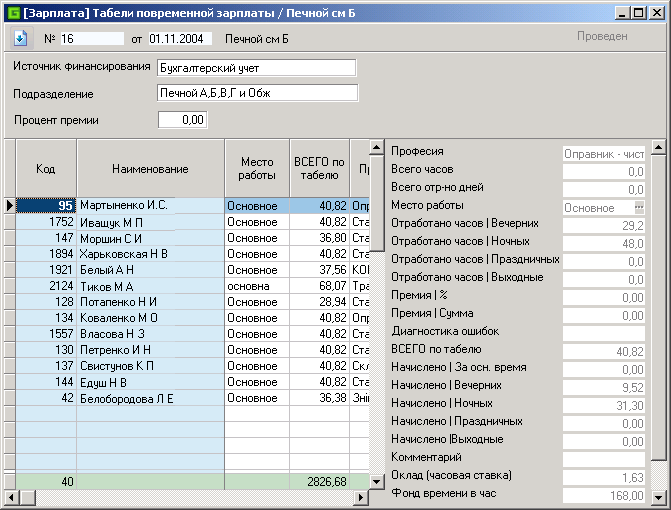

Time-based salary charging operations.

Time table for calculating the time-based salary in days.

Time tables for calculating depend on the method of calculating the salary. Therefore, the structure of operations provides for their collection for various applications. By means of data protection to use, those that are best suited for the enterprise are connected.

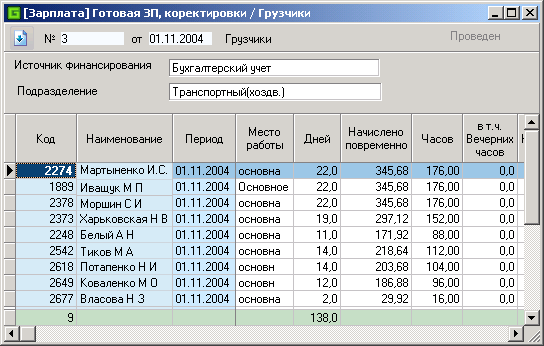

If for some reason, it is more convenient for the accountant to make a manual calculation of the salary for some employees, then he can enter the calculation results into the operation of adjusting the payroll.

Adjustments to the time-based salary.

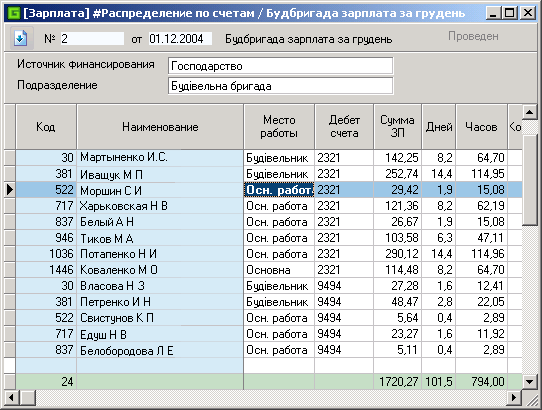

Moving information about the brigade′s salary on production accounts from the journal to the general ledger.

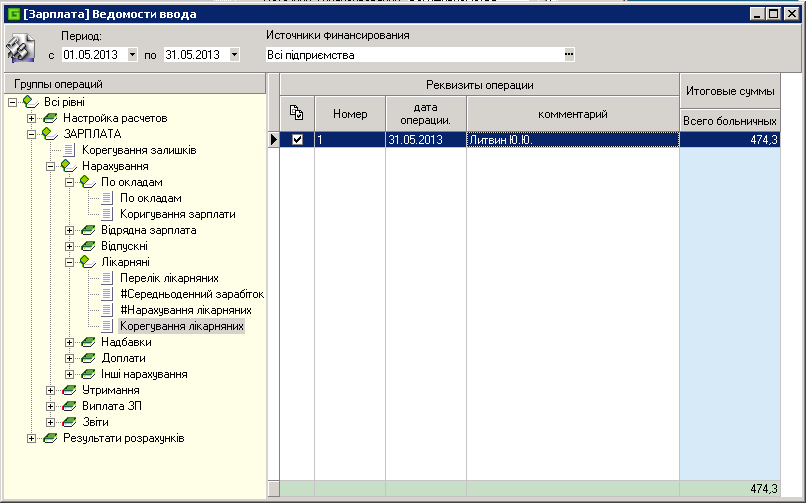

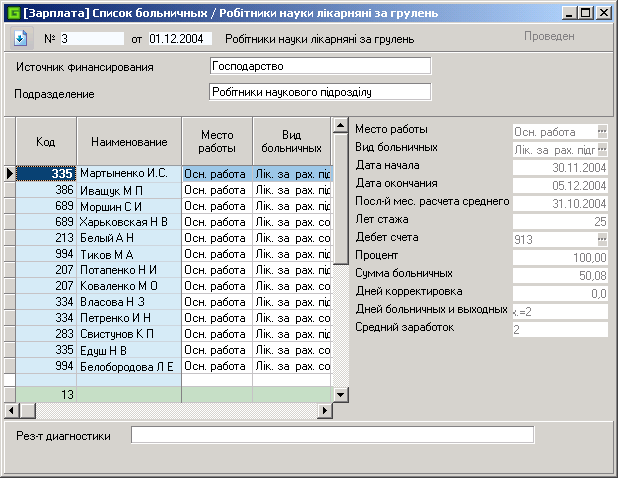

Operations of charge of sick pay.

List of sick leaves.

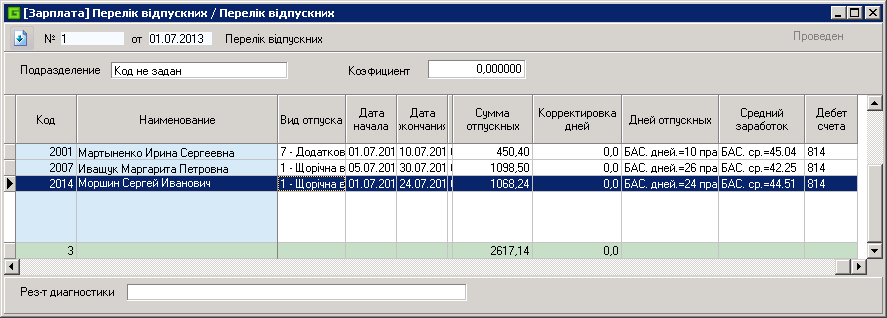

Enter the list of vacations.

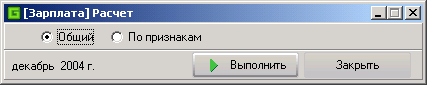

A general calculation of wages.

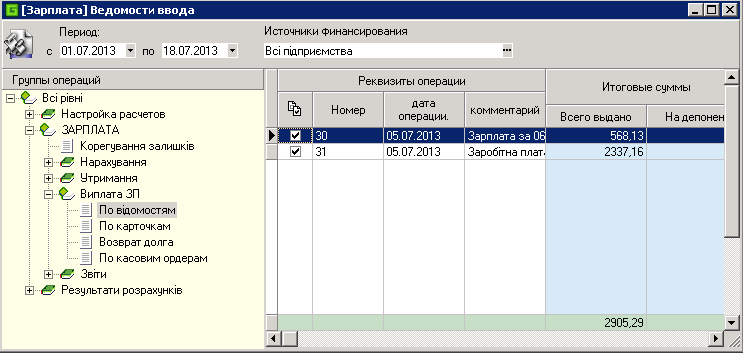

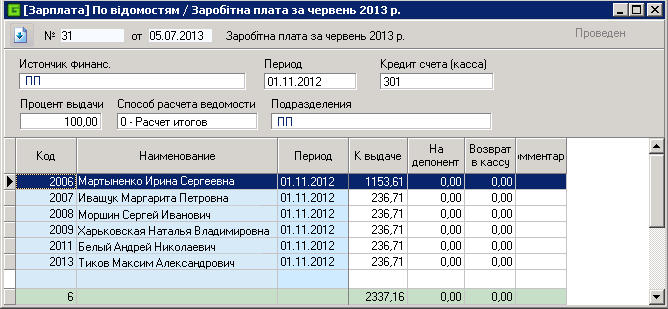

Payroll operations.

The result of the payroll statement.

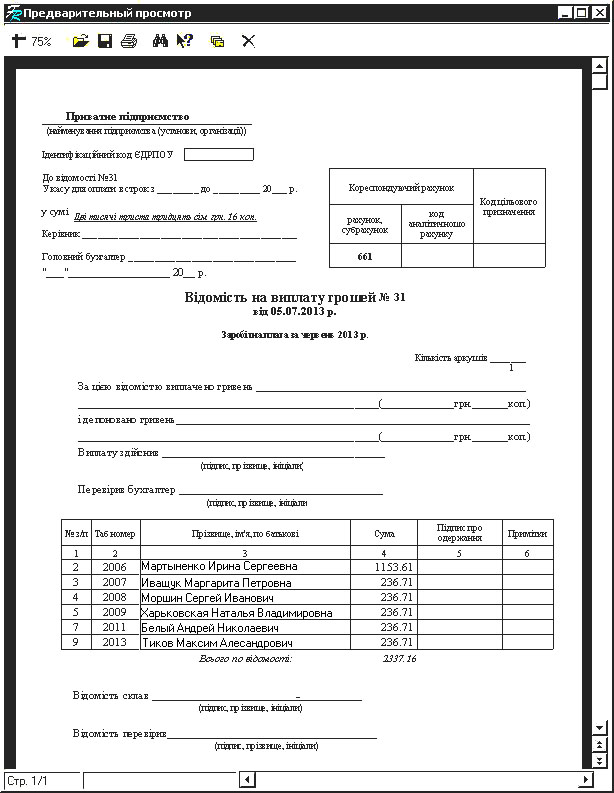

An example of printing a payroll statement in a fixed form.

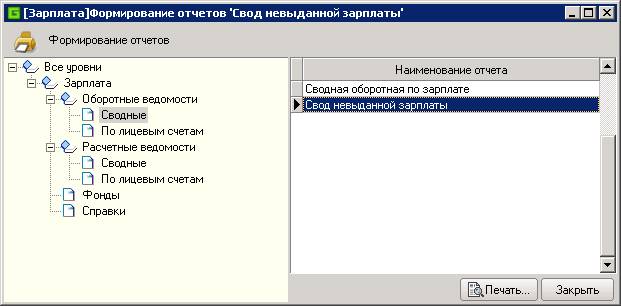

The composition of reports on salary arrears.

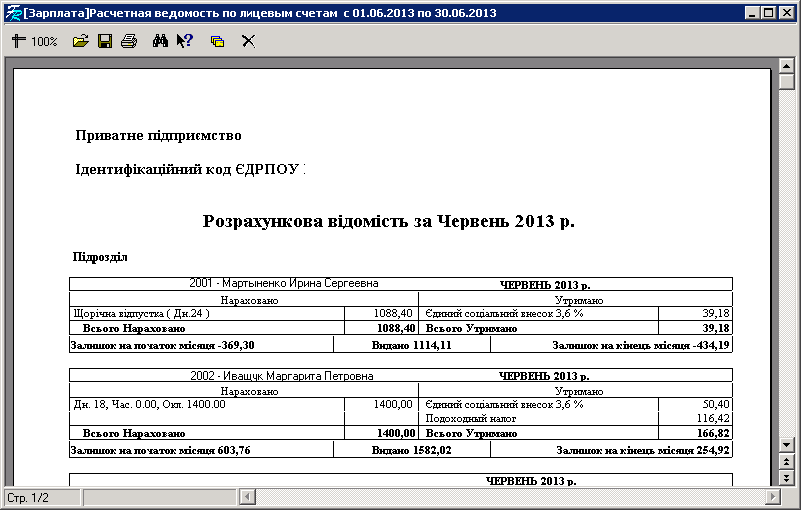

The decription for the consolidated payroll is the "Estimated payroll for employees" report.