FINANCIAL OPERATIONS

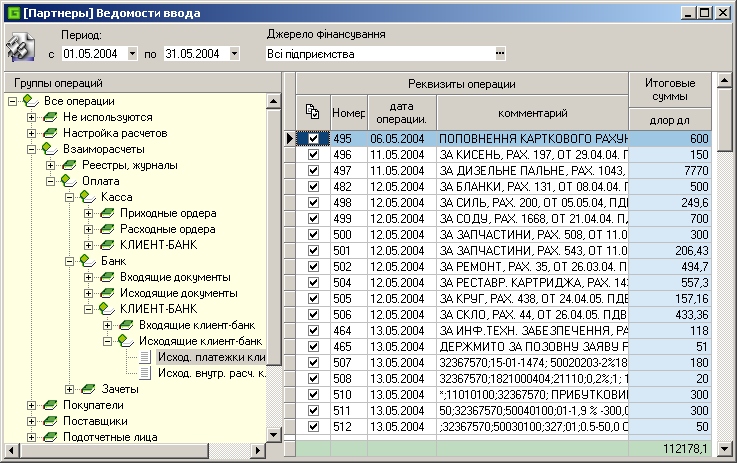

Financial operations are designed to process cash and bank documents. The printing form primary documents correspond to the established requirements, therefore they replace usual forms.

Financial operations are created either for a specific type of work (for example, revenue from the store) or for a particular performer, for example, under the accountant, on accountable persons. The first reason for allocating transactions is to set up accounting transactions. Their composition and parameters are generated automatically according to the settings and are not allowed for manual adjustments because manual adjustments are the most common source of accounting errors. The second reason for this is that the means for protecting access to transactions differentiate the rights of various users.

Financial documents can be entered manually or formed semi-automatically according to the data from the client-bank. At semi-automatic formation, SQL procedure on various parameters of record from the client-bank selects the suitable partner, a kind of data, and the contract and forms the necessary payment document. Formed documents are checked by the accountant, and, if necessary, makes corrections. As a result of corrections, the parameters of personal accounts are specified, and the next time the procedure generates documents more precisely.

The final financial documents, such as the cash book, cash register, journal order, are formed on the basis of accounting transactions and can be printed in the established form.

MUTUAL SETTLEMENTS

There are several types of these partners in terms of the generality of their processing:

- Buyers;

- Suppliers;

- Accountable persons;

- Other debtors, creditors.

The same partner can have any of the listed types of data. For each type of data, mutual settlements (turnover sheets) are conducted in the context of contracts.

The initial data for all calculations are primary transactions and accounting tracsactions made on their basis. All the current work of the user is to process the primary documents and analyze the status of mutual settlements, based on reporting documents and operational information.

Some primary documents can be generated by the program itself, for example, tax bills, bills for payment. It is also possible to print out registers of any primary documents.

The program has online access to data of all previously processed reporting periods. "Closing the reporting period" is used only to exclude accidental data entry in the past periods for which reports are generated. A user with the corresponding access pairs can instantly open the period, and if it is necessary to perform adjustments in it, or close it, in order to prevent the change.

For all types of data, except for other debtor-creditors, tax credits and tax liabilities are recorded. For buyers, the amount of gross income is calculated and the first event is tracked.

REPORTING DOCUMENTS

There is a standard set of reporting documents for each type of data:

- turnover sheets, accounting accounts, partners, partner groups;

- debit and credit turnover of mutual settlements;

- statements of reconciliation of mutual settlements with partners.

The summary turnover sheet on accounts of accounting is intended for granting of final data on mutual settlements. The data of this sheet coincide with the final balances on the accounts of accounting in the balance sheet of the enterprise, as well as with their final turnover sheets, in debit and under the loan.

The turnover sheet, according to partners, is designed to track mutual settlements with partners. Balance at the beginning of the period, turnover sheets and balances at the end are shown in the context of contracts but can be provided in summary form for each partner.

The sheets of debit and credit turnovers are a transcript of the negotiable statements. They contain a list of all the operations performed, indicating the entries made and references to primary documents.

The reconciliation checklist is designed to reconcile mutual settlements with partners. It gives the data of the executed operations for the specified period, including the balance at the beginning of the reconciliation and the balance at the end of the reconciliation period.

The statement of the balances, for a given date, is intended for internal use and information to the management of the enterprise.

Statement on the accrual of fine is used by the legal service in the preparation of statements of claim. It contains information about how the fine was charged, taking into account changes in the interest rate, invoices issued and payments received.

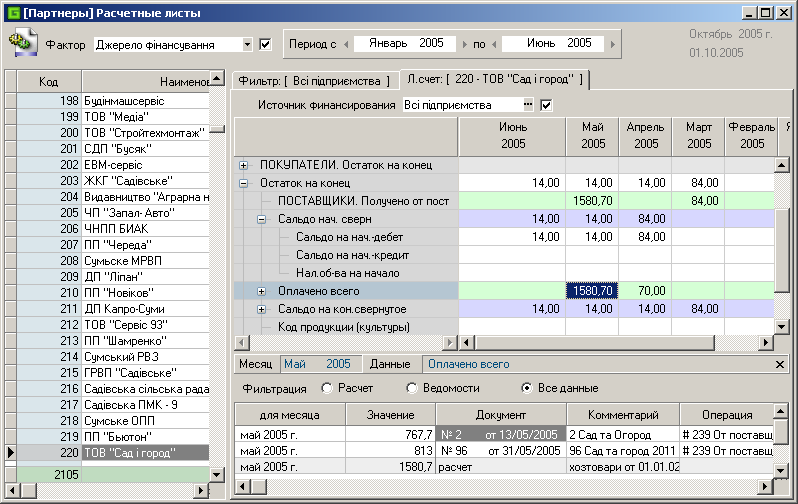

THE ANALYSIS OF THE RESULTS

This is the main online mode for analyzing the results of the operations performed. It allows you to see the history of data changes, data sources (primary operations) and then go directly to the operation of interest.

The displayed data on the window has a tree structure, which is formed by means of setting the data type. At the upper levels, the most important and most often interesting information is usually taken out. At the lower levels is the detailed information. These levels are disclosed to refine more general data.

From this mode, printouts of reports for the current partner are also available, for example, reconciliation report, and reconciliation sheet.